Filed by the Registrantx | |||||

Filed by a Party other than the Registranto | |||||

| Check the appropriate box: | |||||

| o | Preliminary Proxy Statement | ||||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| x | Definitive Proxy Statement | ||||

| o | Definitive Additional Materials | ||||

| o | Soliciting Material | ||||

| AdvanSix Inc. | |||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| x | No fee required. | |||||||

| o | Fee paid previously with preliminary materials. | |||||||

| o | Fee computed on table | |||||||

| |||||||||||

| 2024 | Proxy Statement | ||||||||||

and Notice of | |||||||||||

of | |||||||||||

| Stockholders |

2017 Notice of Annual Meeting of Stockholders and Proxy Statement

26, 2024

Virtual Annual Meeting” in the proxy statement for additional information regarding how to attend and participate at the Annual Meeting.

compensation.

3:

Proposal 4: Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation

Proposal 5: Approval of the Material Terms of Performance-Based Compensation for Purposes of Section 162(m) of the Internal Revenue Code under the 2016 Stock Incentive Plan of AdvanSix Inc. and its Affiliates

| ||||||||

|  | |||||||

| Erin N. Kane | ||||||||

| President and Chief Executive Officer | ||||||||

13, 2024

Eastern Time

18, 2024

| By Telephone |   | By Internet |   | By Mail |   | By Scanning | |||||||||||||||||||||||||||||||||||||||||||

| In the U.S. or Canada, you can vote your shares by calling +1 (800) 690-6903. You will need the | You can vote your shares online atwww.proxyvote.com. You will need the | You can vote your shares by mail by marking, dating and signing your proxy card or voting instruction form and returning it in the postage-paid envelope. | You can vote your shares online by scanning the QR code above. You will need the | |||||||||||||||||||||||||||||||||||||||||||||||

26, 2024.

John M. Quitmeyer

| TABLE OF CONTENTS | ||||||||||||||||

SEC Filings and Section 16(a) | 19 | |||||||||||||||

Corporate Social Responsibility and Sustainability | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

| • | ||||||||||||||||

13, 2024. See Appendix A for information regarding forward-looking statements and non-GAAP measures presented in this proxy statement.

AdvanSix’s Board

Our Board has nominated the Class I director nominees for re-election as directors. qualified.

| KEY STATISTICS ABOUT OUR DIRECTOR NOMINEES | ||||||||||||||

| 7 of 8 | 50% | 100% | 100% | 59 years | ||||||||||

Independent | Gender/Ethnic Diversity | Senior Leadership Experience | Operations, ESG, HS&E and Sustainability Experience | Average Age | ||||||||||

| 1 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

|

| DIRECTOR SKILLS AND QUALIFICATIONS CRITERIA | ||||||||

| Senior Leadership Experience Experience serving as CEO or a senior executive provides a practical understanding of how complex organizations function and hands-on leadership experience in core management areas, such as strategic and operational planning, financial reporting, human capital management, compliance, risk management, mergers and acquisitions, and leadership development. | |||||||

| Industry Experience Experience in our industry enables a better understanding of the issues facing the Company’s business as well as risk management. | |||||||

| Operations, ESG, HS&E and Sustainability Experience Experience with the operations of complex, continuous manufacturing and Environmental, Social and Governance ("ESG") topics, including health, safety, and environmental ("HS&E") and sustainability matters, provides critical perspective in understanding and evaluating operational planning, management, and risk mitigation. | |||||||

| Financial Expertise We believe that an understanding of finance and financial reporting processes is important for our directors to monitor and assess the Company’s operating performance and to support accurate financial reporting and robust controls. Our directors have relevant background and experience in capital markets, corporate finance, accounting and financial reporting and several satisfy the “accounting or related financial management expertise” criteria set forth in the New York Stock Exchange (“NYSE”) listing standards. | |||||||

| Regulated Industries Experience AdvanSix is subject to a broad array of government regulations and demand for its products and services can be impacted by changes in law or regulation in areas such as safety, security and energy efficiency. Several of our directors have experience in regulated industries, providing them with insight and perspective in working constructively and proactively with governments and agencies. | |||||||

| Public Company Board Experience Service as an executive officer, as well as on the boards and board committees, of public companies provides an understanding of corporate governance practices and trends and insights into board management, relations between the board, the CEO and senior management and stockholders, agenda setting and succession planning. | |||||||

| 2 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| Experience, Expertise or Attributes | Erin N. Kane | Farha Aslam | Darrell K. Hughes | Todd D. Karran | Gena C. Lovett, Ph.D. | Daniel F. Sansone | Sharon S. Spurlin | Patrick S. Williams | ||||||||||||||||||

| Senior Leadership | · | · | · | · | · | · | · | · | ||||||||||||||||||

| Industry | · | · | · | · | · | · | · | |||||||||||||||||||

| Operations, ESG, HS&E and Sustainability | · | · | · | · | · | · | · | · | ||||||||||||||||||

| Financial | · | · | · | · | · | · | · | · | ||||||||||||||||||

| Regulated Industries | · | · | · | · | · | · | ||||||||||||||||||||

| Public Company Board | · | · | · | · | · | · | · | · | ||||||||||||||||||

| CEO Experience | · | · | · | · | ||||||||||||||||||||||

| Demographics | ||||||||||||||||||||||||||

| Race/Ethnicity | ||||||||||||||||||||||||||

| Black or African American | · | |||||||||||||||||||||||||

| Native Hawaiian or other Pacific Islander | ||||||||||||||||||||||||||

| White | · | · | · | · | · | · | ||||||||||||||||||||

| Hispanic or Latino | ||||||||||||||||||||||||||

| American Indian or Alaska Native | ||||||||||||||||||||||||||

| Asian | · | |||||||||||||||||||||||||

| Two or More Races | ||||||||||||||||||||||||||

| Gender | ||||||||||||||||||||||||||

| Male | · | · | · | · | ||||||||||||||||||||||

| Female | · | · | · | · | ||||||||||||||||||||||

| Independent Director | · | · | · | · | · | · | · | |||||||||||||||||||

DIRECTOR SKILLS AND QUALIFICATIONS CRITERIA

Senior Leadership Experience

Experience serving as CEO or a senior executive provides a practical understanding of how complex organizations function and hands-on leadership experience in core management areas, such as strategic and operational planning, financial reporting, compliance, risk management and leadership development.

Industry Experience

Experience in our industry enables a better understanding of the issues facing the Company’s businesses.

Financial Expertise

We believe that an understanding of finance and financial reporting processes is important for our directors to monitor and assess the Company’s operating performance and to ensure accurate financial reporting and robust controls. Our director nominees have relevant background and experience in capital markets, corporate finance, accounting and financial reporting and several satisfy the “accounting or related financial management expertise” criteria set forth in the New York Stock Exchange (“NYSE”) listing standards.

Regulated Industries Experience

AdvanSix is subject to a broad array of government regulations and demand for its products and services can be impacted by changes in law or regulation in areas such as safety, security and energy efficiency. Several of our directors have experience in regulated industries, providing them with insight and perspective in working constructively and proactively with governments and agencies.

Public Company Board Experience

Service on the boards and board committees of other public companies provides an understanding of corporate governance practices and trends and insights into board management, relations between the board, the CEO and senior management, agenda setting and succession planning.

Each of the nominees is also independent of the Company and management. See “Director Independence” on page 11 of this proxy statement. The Nominating and Governance Committee also considered the specific experience described in the biographical details that follow in determining to nominate the individuals below for election as directors.

The Board See “Director Independence” on page 13 of Directors unanimously recommends a vote FOR the election of each of the director nominees.

|

| The Board of Directors unanimously recommends a vote FOR the election of each of the director nominees. | ||||

| 3 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| Farha Aslam | |||||||||||

| Ms. Aslam (55) is a Managing Partner at Crescent House Capital, an investment and strategic advisory firm she founded that focuses on the agriculture, energy, and food processing industries. Ms. Aslam has worked in the finance industry since 1996. Prior to founding Crescent House in 2019, she was Managing Director at Stephens Inc. from 2004 until 2018, where she led the firm’s Food and Agribusiness equity research team and built a top-tier research franchise that spanned the grain, ethanol, protein, and packaged food sectors and successfully positioned several lead managed equity offerings and debt financings. Previously, Ms. Aslam was a vice president at Merrill Lynch and a risk management advisor at UBS. Ms. Aslam serves on the boards of directors of Green Plains Inc. (Nasdaq: GPRE), Pilgrim’s Pride Corporation (Nasdaq: PPC); and Calavo Growers, Inc. (Nasdaq: CVGW). Ms. Aslam graduated from the University of California with a B.A. degree in Economics. She holds a Master of Business Administration degree from Columbia University. Ms. Aslam brings to the Board extensive experience with senior leadership, business strategy, public company governance, equity and capital markets, as well as financial and accounting expertise. Ms. Aslam has served as a director of AdvanSix since December 2021. | ||||||||||

| Board Committees*: Audit; Nominating and Governance | |||||||||||

| Darrell K. Hughes | |||||||||||||

|

|

Mr. Hughes (58) has been President and Mr. Hughes brings to the Board the operational and financial expertise gained through nearly 30 years of companies, as well as experience in the chemicals industry, including strategy development and growth, and mergers and acquisitions. Mr. Hughes has served as a director of AdvanSix since the spin-off from Honeywell on October 1, 2016. | |||||||||||

| Board Committees*: Compensation and Leadership Development; Health, Safety and Environmental | |||||||||||||

| 4 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| Erin N. Kane | |||||||||||

| Ms. Kane (47) has been President and Chief Executive Officer and a director of AdvanSix since the spin-off on October 1, 2016. Prior to joining AdvanSix, Ms. Kane served as Vice President and General Manager of Honeywell Resins and Chemicals since October 2014. She joined Honeywell in 2002 as a Six Sigma Blackbelt of Honeywell’s Specialty Materials business. In 2004, she was named Product Marketing Manager of Honeywell’s Specialty Additives business. From 2006 until 2008, Ms. Kane served as Global Marketing Manager of Honeywell’s Authentication Technologies business, and in 2008 she was named Global Marketing Manager of Honeywell’s Resins and Chemicals business. In 2011, she was named Business Director of Chemical Intermediates of Honeywell’s Resins and Chemicals business. Prior to joining Honeywell, Ms. Kane held Six Sigma and process engineering positions at Elementis Specialties and Kvaerner Process. Ms. Kane serves on the Boards of Directors of the Chemours Company (NYSE: CC), and the American Chemistry Council. She served on the Board of Directors of the American Institute of Chemical Engineers (AIChE) from 2019 through 2021. Ms. Kane brings to the Board her extensive leadership experience as well as knowledge of AdvanSix’s business, industry, and operations/HSE and sustainability. | ||||||||||

| Todd D. Karran | |||||||||||||

|

|

Mr. Karran (59) has Corporate Development. Chemicals, with extensive chemicals industry experience including operations/HSE and sustainability, global business, as well as strategy development and growth. | |||||||||||

CONTINUING DIRECTORS

Class II Directors (with terms expiring at the 2018 Annual Meeting of Stockholders)

| |||||||||||

|

Dr. Lovett (61) has a Ph.D. in Values Driven Leadership from Benedictine University. Dr. Lovett previously was the

Dr. Lovett brings to the Board

Dr. Lovett has served as a director of AdvanSix since | ||||||||||

| Board Committees: Health, Safety, and Environmental; Nominating and Governance | |||||||||||

| 5 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| Daniel F. Sansone | |||||||||||||

|

|

Mr. Sansone (71) was Mr. Sansone is a director of Ingevity Mr. Sansone brings to the Board over 40 years of senior leadership, general management and financial and accounting experience as both an executive officer and board member of public companies, as well as experience with mergers and acquisitions, and regulated industries. Mr. Sansone has served as a director of AdvanSix since the spin-off from Honeywell on October 1, 2016. | |||||||||||

| Board Committees: Audit; Health, Safety and Environmental | ||||||||||||

| Sharon S. Spurlin | |||||||||||||

|

|

Ms. Spurlin (59) has been

controls, as well as senior leadership experience in operations/HS&E, ESG and sustainability, regulated industries, risk management, and public companies. | |||||||||||

| Board Committees*: Audit; Compensation and Leadership Development | |||||||||||||

Class III Directors (with terms expiring at the 2019 Annual Meeting of Stockholders)

| |||||||||||

|

| ||||||||||

|

| growth.

| ||||||

| Board Committees*: Compensation and Leadership Development; Nominating and Governance | ||||||||||||

| 6 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

KEY CORPORATE GOVERNANCE DOCUMENTS

Please visit our website atwww.Advan6.com (see “Investors”—“Corporate Governance”) to view the following documents:

KEY CORPORATE GOVERNANCE DOCUMENTS Please visit our website at www.AdvanSix.com (see “Investors”—“Corporate Governance”) to view the following documents: | |||

•Certificate of Incorporation and By-laws | |||

• | Corporate Governance Guidelines | ||

•Code of Business Conduct | |||

• | Board of Directors Code of | ||

• | |||

Our Code of Business Conduct (the "Code of Conduct") applies to all directors, officers (including the Chief Executive Officer, Chief Financial Officer and Controller) and employees.employees, and our Board of Directors Code of Ethics Guidelines (the "Board Code of Ethics") applies to our directors. Amendments to, or waivers of, the Code of Conduct and the Board Code of Ethics granted to any of our directors or executive officers, as applicable, will be publisheddisclosed on our website.

Since the spin-off from Honeywell on October 1, 2016,

meetings of the independent directors when necessary and appropriate.

| 7 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

The Board’s Chairman shall act as chair at all Board meetings and is responsible for establishing the agenda for each Board meeting. In addition, the Chairman serves as liaison betweenCommittees provide feedback to management and management answers questions raised by the independent directors to provide feedback from executive sessionsduring Board and callCommittee meetings.

|

Board Practices and Procedures

| 8 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

Committee Membership

The table below lists the current membership of each Committee and the number of Committee meetings held during 2016, following the spin-off from Honeywell.

| Name | Audit | Compensation | Nominating and Governance | ||||

| Mr. Huck | X* | X | |||||

| Mr. Hughes | X | ||||||

| Mr. Karran | X | X | |||||

| Mr. Sansone | X | X* | |||||

| Ms. Spurlin | X | X* | |||||

| 2016 Meetings | 2 | 2 | 1 |

* Committee Chairperson

Board Committees and Responsibilities

The primary functions of each of the Board Committees are described below.

Audit Committee

The Audit Committee was established in accordance with Section 3(a)(58)(A) and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The responsibilities of our Audit Committee include overseeing:

Members (1) | 2023 Meetings | ||||||||||

| Audit Committee | Mr. Sansone* | •Overseeing our financial reporting process (including | 6 | ||||||||

| Ms. Aslam | |||||||||||

• | |||||||||||

| Ms. Spurlin | |||||||||||

• | |||||||||||

•Overseeing our independent accountants' annual audit of our financial statements; | |||||||||||

• | |||||||||||

•Overseeing ESG matters including disclosure of human capital management and related metrics; | |||||||||||

•Overseeing cybersecurity and security of Company data and information; and | |||||||||||

•Reviewing and approving certain reports required by SEC rules and regulations. | |||||||||||

| Compensation and Leadership Development Committee | Ms. Spurlin* | •Establishing and periodically reviewing our compensation philosophy; | 5 | ||||||||

| Mr. Hughes | •Evaluating the | ||||||||||

| Mr. Williams | •Reviewing and approving the compensation of our other executive officers, as well as evaluating Board compensation; | ||||||||||

• | Overseeing the | ||||||||||

•Overseeing the administration and determination of | |||||||||||

•Reviewing and approving, and overseeing and monitoring compliance with, policies with respect to the recovery or "clawback" of compensation; | |||||||||||

•Overseeing human capital management and ESG matters relating to leadership development and equity, diversity and inclusion ("ED&I") initiatives; and | |||||||||||

•Reviewing and approving any report on executive compensation required by the rules and regulations of the SEC. | |||||||||||

| Nominating and Governance Committee | Mr. Williams* | •Overseeing our corporate governance practices and related matters; | 5 | ||||||||

| Ms. Aslam | •Adopting and reviewing policies regarding the consideration of candidates for our Board proposed by stockholders and other criteria for Board membership; | ||||||||||

| Dr. Lovett | •Identifying, reviewing and recommending individuals for election to the Board; | ||||||||||

•Reviewing and making recommendations to our Board regarding the structure of our various Board Committees; | |||||||||||

•Overseeing policies, performance and goals in the areas of corporate social responsibility and sustainability including governance practices associated with ESG matters including that applicable Committees and/or the Board are chartered with appropriate oversight and responsibilities, as needed; | |||||||||||

•Overseeing integrity and compliance incident reporting; | |||||||||||

•Overseeing public policy and governmental relations matters; and | |||||||||||

•Overseeing our annual Board and Committee self-evaluations. | |||||||||||

| Health, Safety and Environmental Committee | Dr. Lovett* | •Overseeing and providing guidance on HS&E, process safety management and related programs; | 4 | ||||||||

| Mr. Hughes | •Reviewing effectiveness of HS&E management systems, reporting processes and systems of internal controls to ensure compliance with applicable regulations and laws and Company policies and procedures; and | ||||||||||

| Mr. Sansone | •Overseeing risk management programs relating to HS&E. | ||||||||||

The Audit Committee

|

business judgment. The Board has determined that Messrs. Huck, Karran, and Sansone satisfy the “accounting or related financial management expertise” requirements set forth in the NYSE listing standards, and has designated each of Mr. HuckSansone, Ms. Aslam and Ms. Spurlin as the Securities and Exchange Commission (“SEC”) definedan SEC-defined “audit committee financial expert.” See page 38 for

| 9 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

Compensation Committee

The responsibilities of our Compensation Committee include, among other duties:

The Compensation Committee consists entirely of independent directors, each of whom meets the independence requirements set forth in the listing standardscomposition, effective June 15, 2023:

the C&LD Committee and ceased serving on the Nominating and Governance Committee;

The responsibilities of our and ceased serving on the Audit Committee;

•Mr. Williams was appointed as Chair of the Nominating and Governance Committee. Mr. Michael Marberry, who served as director and Board Chair since 2016, retired from his Board position effective as of June 15, 2023. Board Committee Oversight of Environmental, Social and Governance Matters The Board exercises oversight with respect to ESG matters including (i) ensuring that the | |

The Nominating and Governance Committee consists entirelyconducts a periodic assessment of independent directors,ESG categories to confirm they are appropriately captured within the chartered responsibilities of applicable Committees; (ii) a periodic assessment of ESG-related matters escalated by applicable Committees, from time to time, for full Board oversight; and (iii) a periodic evaluation of applicable ESG-related enterprise risk management considerations. Each Committee plays an important role in assisting the Board with its ESG oversight responsibilities. The following graphic shows the ESG responsibilities assigned to each Committee.

| Environmental | Social | Governance | ||||||||||||||||||||||||||||||||||||||||||

Committee | HS&E and Process Safety | Regulatory | Climate | Corp Social Resp. & Sustain. | ED&I | Human Capital Management | Leadership Dev | Executive Succession Planning | Gov't Rel. | Cyber | ERM | ESG Metrics | Business Conduct Incident Reviews | Board Composition | ||||||||||||||||||||||||||||||

| HS&E | ||||||||||||||||||||||||||||||||||||||||||||

| C&LD | ||||||||||||||||||||||||||||||||||||||||||||

| Audit | ||||||||||||||||||||||||||||||||||||||||||||

| Nom & Gov | ||||||||||||||||||||||||||||||||||||||||||||

oversees a formal annual Board and Committee self-evaluation process including holding one-on-one meetings with each director. The results of this self-evaluation process are reviewed by the Nominating and Governance Committee as well as by each Committee Chair, and summarized for the full Board to discuss during a dedicated session where a facilitated discussion seeks to comprehensively reflect on the results. During 2023, the self-evaluation session was further supported by a third-party consultant that conducted individual director interviews and facilitated a full Board discussion. Based on the evaluation process in 2023, the Board and Committees implemented certain changes to meeting schedules, agendas, as well as meeting materials, and determined to continue individual meetings with the CEO to support and drive continuous improvement of the Board's effectiveness, oversight responsibilities and governance.

our Internal Audit Director.

2024.

| 10 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

|

C&LD Committee’s established policy, its consultant cannot provide any other services to AdvanSix. Since November 2016,Pearl Meyer has served as the Committee has retained Korn Ferry Hay Group (“Hay Group”) as itsC&LD Committee's independent compensation consultant.

consultant since November 2017.

Hay Group

remote communication.

officers served on the compensation committee (or its equivalent) or board of directors of another entity whose executive officer served on the C&LD Committee.

| 11 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

|

reports to the Board and each Committee periodically on specific, material risks as they arise or as requested by individual Board members.

provided on a regular basis to support continuous oversight and assessment.

| Board/Committee | Primary Areas of Risk Oversight | ||||||||||

| Full Board | • | ||||||||||

| • | Plant outages, supply chain and logistical disruptions, raw material price inflation, labor relations, customer demand, and competitive risk | ||||||||||

| • | Capital structure and allocation, and development of financial policy including liquidity and debt management | ||||||||||

| • | |||||||||||

| • | Catastrophic events such as | ||||||||||

| Audit Committee | • | ||||||||||

| Cybersecurity, including IT infrastructure, protection of customer and employee data, trade secrets and other proprietary information, ensuring the security of data, persistent threats and cyber risks | |||||||||||

| • | |||||||||||

| Tax and liquidity management, financial, solvency, capital structure and credit risks | |||||||||||

| • | Employee pension and saving plans | ||||||||||

| • | Employee misconduct related to books, records and financial controls | ||||||||||

| Nominating and Governance | • | Code of Conduct and Board Code of Ethics compliance | |||||||||

| Committee | • | Litigation, labor issues, intellectual property infringement, regulatory issues such as Foreign Corrupt Practices Act ("FCPA"), and product liability | |||||||||

| • | Compliance matters associated with import/export and FCPA | ||||||||||

| • | |||||||||||

| • | |||||||||||

| • | |||||||||||

| • | Potential conflicts of interest and | ||||||||||

| Compensation and Leadership Development Committee | • | ||||||||||

| • | Performance, development and retention of senior management | ||||||||||

| • | ED&I policies and initiatives | ||||||||||

| • | Executive succession planning | ||||||||||

| Health, Safety, and Environmental Committee | • | ||||||||||

| • | Effectiveness of health, safety, and environmental management systems, reporting processes and systems of internal controls | ||||||||||

| • | Occupational process safety and environmental reporting | ||||||||||

| 12 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

C&LD Committee, as applicable.

|

| 13 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

|

the procedures set forth in the Company’s By-laws, the Policy Statement regarding Director Nominations and Stockholder Communications, and as described under “Other Information—Director Nominations” in this proxy statement.

| At AdvanSix, we strive for an inclusive work environment that fosters respect for all our coworkers, customers, suppliers and business partners. We value the diversity reflected in the various backgrounds, experiences, and ideas of our directors, employees, contractors, and other stakeholders. |  | ||||

goal to increase our organization’s workforce diversity and improve outreach in the local communities where we operate. In addition, we created a program in 2022 for inclusive leadership, ensuring our leaders understand and have the tools to create an inclusive environment where all can thrive. Our second inclusive leadership cohort kicked off a full year of experiential learning in 2023. We held our third annual Days of Understanding at two of our largest manufacturing facilities to encourage active engagement by leadership with all employees to listen to their experiences and gather feedback for improvement.

| 14 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

All of our directors attended our 2023 Annual Meeting of Stockholders and all of our director nominees are expected to attend the 2024 Annual Meeting of Stockholders.

The compensation program was approved by our Board upon the recommendation of our C&LD Committee, in consultation with its independent compensation consultant, who conducted a comprehensive review of peer group and market data in order to assess total director compensation, consisting of cash retainer fees and annual equity awards, and to align the elements of our director compensation program with our peer group, including the recommended mix of approximately half of total compensation in equity.

Non-employee

In addition, non-employee directors receiveBoard, and they received additional retainers for the following roles:

| 15 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

Stockholders and vest one year from the date of grant.

|

period.

| 16 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| Director Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | All Other Compensation ($) | Total ($) | ||||||||||

| Farha Aslam | $90,000 | $104,988 | — | $194,988 | ||||||||||

| Darrell K. Hughes | $90,000 | $104,988 | — | $194,988 | ||||||||||

| Todd D. Karran | $151,042 | $104,988 | — | $256,030 | ||||||||||

| Gena C. Lovett, Ph.D. | $105,000 | $104,988 | — | $209,988 | ||||||||||

| Michael L. Marberry | $87,083 | — | — | $87,083 | ||||||||||

| Daniel F. Sansone | $110,000 | $104,988 | — | $214,988 | ||||||||||

| Sharon S. Spurlin | $105,000 | $104,988 | — | $209,988 | ||||||||||

| Patrick Williams | $102,500 | $104,988 | — | $207,488 | ||||||||||

| Director Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | All Other Compensation ($) | Total ($) | |||||

| Paul E. Huck | $26,250 | $100,000 | — | $126,250 | |||||

| Darrell K. Hughes | $21,250 | $100,000 | — | $121,250 | |||||

| Todd D. Karran | $24,380 | $100,000 | — | $124,380 | |||||

| Michael L. Marberry | $35,000 | $100,000 | — | $135,000 | |||||

| Daniel F. Sansone | $26,250 | $100,000 | — | $126,250 | |||||

| Sharon S. Spurlin | $24,380 | $100,000 | — | $124,380 |

| Director Name | |||||

| Farha Aslam | 2,975 | ||||

| Darrell K. Hughes | |||||

| Todd D. Karran | |||||

| Gena C. Lovett, Ph.D. | 2,975 | ||||

| Michael L. Marberry | |||||

| Daniel F. Sansone | |||||

| Sharon S. Spurlin | |||||

| Patrick Williams | 2,975 | ||||

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Prior to the completion of the spin-off, our

The Nominating and Governance Committee has delegated to its Chair the authority to review and approve or ratify any related person transaction in which the aggregate amount involved is expected to be less than $500,000, unless the Chair is directly or indirectly involved in such transaction, in which case such authority shall be delegated to another Nominating and Governance Committee member. The Committee Chair’s decision with respect to any such related person transaction shall be reported to the full Nominating and Governance Committee at its next scheduled meeting.

Agreements with Honeywell

Honeywell is

|

Separation and Distribution Agreement

We entered into a Separation and Distribution Agreement with Honeywell on September 22, 2016. The Separation and Distribution Agreement sets forth our agreements with Honeywell regarding the principal actions taken in connection with the spin-off and other agreements that govern aspects of our relationship with Honeywell following the spin-off, as summarized below.

Transfer of Assets and Assumption of Liabilities

The Separation and Distribution Agreement identifies certain transfers of assets and assumptions of liabilities so that we and Honeywell retain the assets of, and the liabilities associated with, our respective businesses. The Separation and Distribution Agreement generally provides that the assets comprising our business consist of those owned or held by us or those primarily related to our current business and operations. The liabilities assumed in connection with the spin-off consist of those related to the past and future operations of our business, including our three current manufacturing locations and the other locations used in our current operations. Honeywell retained assets and assumed liabilities related to former business locations or the operation of our former business. The Separation and Distribution Agreement also provides for the settlement or extinguishment of certain liabilities and other obligations between us and Honeywell.

Internal Transactions

The Separation and Distribution Agreement describes certain actions related to our separation from Honeywell that occurred prior to the spin-off such as the formation of our subsidiaries and certain other internal restructuring actions to be taken by us and Honeywell, including the contribution by Honeywell to us of the assets and liabilities that comprise our business.

Intercompany Arrangements

All agreements, arrangements, commitments and understandings, including most intercompany accounts payable or accounts receivable, between us and Honeywell, terminated effective as of the spin-off date, except specified agreements and arrangements that are intended to survive the spin-off.

Credit Support

We have agreed to use reasonable best efforts to arrange for the replacement of all guarantees, covenants, indemnities, surety bonds, letters of credit or similar assurances of credit support currently provided by or through Honeywell or any of its affiliates for the benefit of us or any of our affiliates.

Representations and Warranties

In general, neither we nor Honeywell make any representations or warranties regarding any assets or liabilities transferred or assumed, any consents or approvals that may be required in connection with these transfers or assumptions, the value or freedom from any lien or other security interest of any assets transferred, the absence of any defenses relating to any claim of either party or the legal sufficiency of any conveyance documents. Except as expressly set forth in the Separation and Distribution Agreement, all assets were transferred on an “as is,” “where is” basis.

Further Assurances

The Separation and Distribution Agreement provides that parties will use reasonable best efforts to effect transfers contemplated by the Separation and Distribution Agreement that were not consummated prior to the spin-off as promptly as practicable following the spin-off date. In addition, the parties will use reasonable best efforts to effect any transfer or re-transfer of any asset or liability that was improperly transferred or retained as promptly as practicable following the spin-off.

The Distribution

The Separation and Distribution Agreement governs Honeywell’s and our respective rights and obligations regarding the spin-off. Prior to the spin-off, Honeywell delivered all the issued and outstanding shares of our common stock to the distribution agent. Following the spin-off date, the distribution agent electronically delivered the shares of our common stock to Honeywell stockholders based on the distribution ratio. The Honeywell board of directors, in its sole and absolute discretion, determined the record date, the distribution date and the terms of the spin-off.

Exchange of Information

We and Honeywell agreed to provide each other with information reasonably necessary to comply with reporting, disclosure, filing or other requirements of any national securities exchange or governmental authority, for use in judicial, regulatory, administrative and other proceedings and to satisfy audit, accounting, litigation and other similar requests. We and Honeywell also agreed to use reasonable best efforts to retain such information in accordance with our respective record retention policies as in effect on the date of the Separation and Distribution Agreement. Each party also agreed to use its reasonable best efforts to assist the other with its financial reporting and audit obligations.

|

| 17 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

Intellectual Property Restrictions and Licenses

We agreed not to assert our intellectual property rights against Honeywell or (with limited exceptions) act to impair Honeywell’s intellectual property rights, and Honeywell agreed not to assert its intellectual property rights against us or (with limited exceptions) act to impair our intellectual property rights, in each case for a period of five years. We granted to Honeywell, and Honeywell granted to us, a perpetual royalty-free license to certain intellectual property that has historically been shared between us and Honeywell and we agreed to negotiate a commercial license with Honeywell under other intellectual property rights in the event either we or Honeywell determine such rights are necessary in order to pursue new projects in the ordinary course of business. These restrictions and licenses will be binding on future licensees or assignees of our and Honeywell’s intellectual property rights.

Release of Claims

We and Honeywell each agreed to release the other and its affiliates, successors and assigns, and all persons that prior to the spin-off have been the other’s stockholders, directors, officers, members, agents and employees, and their respective heirs, executors, administrators, successors and assigns, from any claims against any of them that arise out of or relate to events, circumstances or actions occurring or failing to occur or any conditions existing at or prior to the time of the spin-off. These releases will be subject to exceptions set forth in the Separation and Distribution Agreement.

Indemnification

We and Honeywell each agreed to indemnify the other and each of the other’s current, former and future directors, officers and employees, and each of the heirs, administrators, executors, successors and assigns of any of them, against certain liabilities incurred in connection with the spin-off and our and Honeywell’s respective businesses. The amount of either Honeywell’s or our indemnification obligations will be reduced by any insurance proceeds the party being indemnified receives. The Separation and Distribution Agreement also specifies procedures regarding claims subject to indemnification.

Transition Services Agreement

We entered into a Transition Services Agreement pursuant to which Honeywell provides us, and we provide Honeywell, with specified services, including information technology, financial, human resources and labor, health, safety and environmental, sales, product stewardship, operational and manufacturing support, procurement, customer support, supply chain and logistics and legal and contract and other specified services, for a limited time to help ensure an orderly transition following the spin-off. The services are generally intended to be provided for a period no longer than 24 months following the spin-off. Each of the parties agrees to use its commercially reasonable efforts to take any actions necessary or advisable for it to be able to provide the services for itself as soon as practicable after the spin-off. Each party may terminate the agreement in its entirety in the event of a material breach of the agreement by the other party that is not cured within a specified time period. Each recipient party may also terminate the services on an individual basis upon prior written notice to the party providing the service.

As specified under the Transition Services Agreement, the service provider is generally reimbursed for its direct cost, in addition to an approximately 5% margin on such direct costs, providing the service, which may not necessarily be reflective of prices that could have been obtained for similar services from an independent third-party. The cost of the services to be provided by each party is not expected to be material.

We have agreed to hold Honeywell harmless from any damages arising out of Honeywell’s provision of the services unless such damages are the result of Honeywell’s willful misconduct, gross negligence or breach of certain provisions of the agreement. Additionally, Honeywell’s liability is generally subject to a cap in the amount of fees actually received by Honeywell from us in connection with the provision of the services. We also generally indemnify Honeywell for all liabilities arising out of Honeywell’s provision of the services unless such liabilities are the result of Honeywell’s willful misconduct or gross negligence, in which case, Honeywell indemnifies us for such liabilities. These indemnification and liability terms are customary for agreements of this type.

Given the short-term nature of the Transition Services Agreement, we are in the process of increasing our internal capabilities to eliminate reliance on Honeywell for the transition services it provides as quickly as possible. We have the right under the Transition Services Agreement to terminate our receipt of any service once we develop the internal capabilities to provide the service on a standalone basis, subject to certain limitations.

Tax Matters Agreement

We entered into a Tax Matters Agreement with Honeywell that governs the respective rights, responsibilities and obligations of Honeywell and us after the spin-off with respect to all tax matters (including tax liabilities, tax attributes, tax returns and tax contests).

|

The Tax Matters Agreement generally provides that Honeywell will indemnify us for taxes relating to tax periods prior to the spin-off. Honeywell has the right to control any audit or contest relating to these taxes. In addition, the Tax Matters Agreement provides that we will be required to indemnify Honeywell for any taxes (and reasonable expenses) resulting from the failure of the spin-off and related internal transactions to qualify for their intended tax treatment under U.S. federal income tax law where such taxes result from (a) breaches of covenants and representations we make and agree to in connection with the spin-off, (b) the application of certain provisions of U.S. federal income tax law to these transactions or (c) any other action or omission (other than actions expressly required or permitted by the Separation and Distribution Agreement, the Tax Matters Agreement or other ancillary agreements) we take after the spin-off that gives rise to these taxes. Honeywell has the exclusive right to control the conduct of any audit or contest relating to these taxes, but will not be permitted to settle any such audit or contest without our consent (which we may not unreasonably withhold or delay).

The Tax Matters Agreement imposes certain restrictions on us and our subsidiaries (including restrictions on share issuances, redemptions or repurchases, business combinations, sales of assets, and similar transactions) that are designed to address compliance with Section 355 of the Code and preserve the tax-free nature of the spin-off. These restrictions will apply for the two-year period after the spin-off. Under the Tax Matters Agreement, these restrictions apply unless Honeywell gives its consent for us to take a restricted action, which it is permitted to grant or withhold at its sole discretion. These restrictions may limit our ability to pursue strategic transactions or engage in new businesses or other transactions that may maximize the value of our business, and might discourage or delay a strategic transaction that our stockholders may consider favorable.

Employee Matters Agreement

We entered into an Employee Matters Agreement with Honeywell that addresses employment and employee compensation and benefits matters. The Employee Matters Agreement addresses the allocation and treatment of assets and liabilities relating to employees and compensation and benefit plans and programs in which our employees participated prior to the spin-off. In general, Honeywell generally retained all employment and employee compensation and benefits-related liabilities that relate to periods prior to the spin-off, and we are generally responsible for all employment and employee compensation and benefits-related liabilities relating to our employees and other service providers that relate to periods on and following the spin-off. Specifically, Honeywell retained assets and liabilities with respect to our employees under the Honeywell pension plan and the Honeywell nonqualified and deferred compensation plans. Generally, each of our employees ceased active participation in Honeywell compensation and benefit plans as of the spin-off, with the exception of any continued participation pursuant to the terms of the Transition Services Agreement. The Employee Matters Agreement also provides that we will establish certain compensation and benefit plans for the benefit of our employees following the spin-off, including a 401(k) savings plan, which accepts direct rollovers of account balances from the Honeywell 401(k) savings plan for any of our employees who elect to do so. Generally, following the spin-off, we assumed and are responsible for any annual bonus payments, including with respect to the year in which the spin-off occurs, and any other cash-based incentive or retention awards, other than Growth Plan Units (GPUs) outstanding at the time of the spin-off, to our current and former employees. Honeywell long-term incentive compensation awards, including stock options, RSUs and GPUs, held by AdvanSix employees are treated as described in “Compensation Discussion and Analysis—Details on Program Elements and Related 2016 Compensation Decisions—Long-Term Incentive Compensation.” The Employee Matters Agreement incorporates the indemnification provisions contained in the Separation and Distribution Agreement and described above. In addition, the Employee Matters Agreement provides that we will indemnify Honeywell for any liabilities associated with the active participation of our current and former employees in Honeywell’s benefit plans following the spin-off date.

Site Sharing and Services Agreements

In addition to the above agreements, we entered into site sharing and services agreements with Honeywell, pursuant to which (1) we provide a long-term lease to Honeywell at our Chesterfield, Virginia facility where Honeywell produces SpectraTMadvanced fibers and composite materials, (2) Honeywell provided us with a long-term lease at Honeywell’s Colonial Heights, Virginia facility which serves as one of our R&D and engineering centers, and (3) Honeywell provided us with a long-term lease at Honeywell’s Pottsville, Pennsylvania facility where we produce advanced biaxially oriented nylon film under the Capran®trademark. Each of these leases allow the applicable tenant to access and use a portion of the property in a manner and for the purposes that are consistent with such party’s use immediately prior to the spin-off. Under each agreement, the facility owner—Honeywell in the case of Pottsville and Colonial Heights and AdvanSix in the case of Chesterfield—provides the other party a range of site maintenance, security and support services similar to what a tenant would customarily expect in a multi-tenant facility. Each tenant is responsible for its own on-site commercial and manufacturing activities. Lease payments were determined using arms-length, industrial leasing rates applicable in each geography. The lease payments may be increased based on the fair market rental value of the rented premises under certain circumstances. Site maintenance, security and support services are provided at each party’s direct costs. Each agreement has an initial term of approximately two years,

|

which renews automatically for successive two year terms unless earlier terminated pursuant to the terms of the agreement. Either party may terminate upon two years prior written notice to the extent that the continuation of the Agreement is no longer commercially feasible. Additionally, the applicable tenant under each agreement may terminate the agreement upon 12-months prior written notice received by a specified date within each term.

Other Arrangements

We intend to supply Honeywell’s requirements for acetaldehyde oxime (“AAO”) and 2-pentanone oxime (“2PO”) under a two year, fixed cost supply agreement. For the year ended December 31, 2016, our AAO/2PO product sales to Honeywell generated $9.1 million in sales and represented 0.8% of our 2016 total sales. Both products are currently manufactured by us in Hopewell, Virginia. No additional production equipment or expansions are required to supply these products to Honeywell. The two chemicals are sold by Honeywell’s Specialty Chemicals business primarily into the agricultural and sealant sectors.

|

| Name | Amount and Nature of Beneficial Ownership | Percentage of Class | |||||||

| Directors and Named Executive Officers: | |||||||||

| Jonathan Bellamy | 56,553 | * | |||||||

| Christopher Gramm | 35,040 | * | |||||||

| Paul E. Huck | 6,094 | * | |||||||

| Darrell K. Hughes | 6,094 | * | |||||||

| Erin N. Kane | 407,406 | 1.3 | % | ||||||

| Todd D. Karran | 6,094 | * | |||||||

| Michael L. Marberry | 8,594 | * | |||||||

| Michael Preston | 139,347 | * | |||||||

| John M. Quitmeyer | 145,461 | * | |||||||

| Daniel F. Sansone | 6,094 | * | |||||||

| Sharon S. Spurlin | 6,094 | * | |||||||

| All directors and executive officers as a group (11 persons) | 822,871 | 2.7 | % | ||||||

| Principal Stockholders: | |||||||||

| BlackRock, Inc.(1) 55 East 52nd Street New York, NY 10022 | 3,532,326 | 11.6 | % | ||||||

| Firefly Value Partners, LP(2) c/o dms Corporate Services, Ltd. P.O. Box 1344 dms House 20 Genesis Close Grand Cayman, KY1-1108 Cayman Islands | 2,034,249 | 6.7 | % | ||||||

| JPMorgan Chase & Co.(3) 270 Park Ave New York, NY 10017 | 1,608,469 | 5.3 | % | ||||||

| Norges Bank (The Central Bank of Norway)(4) Bankplassen 2 PO Box 1179 Sentrum NO 0107 Oslo, Norway | 1,524,693 | 5.0 | % | ||||||

|

| Name | Amount and Nature of Beneficial Ownership | Percentage of Class | ||||||||||||||||||

| Directors and Named Executive Officers: | Common Stock (1) | Other Stock-Based Holdings (2) | ||||||||||||||||||

| Farha Aslam | 2,758 | — | * | |||||||||||||||||

| Christopher Gramm | 80,684 | — | * | |||||||||||||||||

| Darrell K. Hughes | 28,632 | 1,840 | * | |||||||||||||||||

| Erin N. Kane | 857,518 | — | 3.2% | |||||||||||||||||

| Todd D. Karran | 41,270 | 25,810 | * | |||||||||||||||||

| Achilles B. Kintiroglou | 64,622 | — | * | |||||||||||||||||

| Gena C. Lovett, Ph.D. | 2,758 | — | * | |||||||||||||||||

| Michael Preston | 273,604 | — | 1.0% | |||||||||||||||||

Daniel F. Sansone(3) | 52,280 | 3,253 | * | |||||||||||||||||

| Kelly Slieter | 42,918 | — | * | |||||||||||||||||

| Sharon S. Spurlin | 47,839 | 13,039 | * | |||||||||||||||||

| Patrick S. Williams | 14,232 | 4,665 | * | |||||||||||||||||

| All directors and executive officers as a group (12 persons) | 1,509,115 | 59,276 | 5.6% | |||||||||||||||||

| Principal Stockholders: | ||||||||||||||||||||

BlackRock, Inc. (4) 50 Hudson Yards New York, NY 10001 | 4,905,819 | 18.3% | ||||||||||||||||||

| Victory Capital Management Inc. (5) 4900 Tiedeman Rd. 4th Floor, Brooklyn, OH 44144 | 2,579,788 | 9.6% | ||||||||||||||||||

| The Vanguard Group (6) 100 Vanguard Blvd. Malvern, PA 19355 | 2,067,702 | 7.7% | ||||||||||||||||||

| Dimensional Fund Advisors LP (7) 6300 Bee Cave Road, Building One Austin, TX 78746 | 1,665,457 | 6.2% | ||||||||||||||||||

| 18 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

REPORTS

SUSTAINABILITY

Our initiatives are supported by AdvanSix's Sustainability Council, comprised of subject matter experts throughout our organization, with a critical, strategic mission -- As our customers’ trusted partner for Advantaged Chemistries, we will advance on our path forward by remaining true to our core values, serving as a responsible corporate citizen, adapting to the needs of our stakeholders and delivering innovative ideas for a sustainable future. The Sustainability Council advises on the sustainability program and relevant ESG matters including progress on key initiatives and sustainability reporting. On at least a quarterly basis, a report and update on such matters is provided to the Nominating and Governance Committee of the Board, which oversees our policies and programs relating to sustainability matters and our role as a responsible corporate citizen. For information regarding Board Committee oversight of key environmental, social and governance matters, please see above under "Corporate Governance - Board Committees - Board Committee Oversight of Environmental, Social and Governance Matters." |  | |||||||||||||

| 19 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| We adhere to the Responsible Care® Guiding Principles, which encourage: |  | |||||||

•Ethical leadership | ||||||||

•Product safety | ||||||||

•A culture which reduces and manages process safety risk | ||||||||

•Reduction of pollution and waste | ||||||||

•Continuous improvement in environmental, health, safety and security performance | ||||||||

| Our Sustainability Report and more information about our corporate social responsibility and sustainability initiatives can be found on our Sustainability website at https://www.advansix.com/about/manufacturing-sites/sustainability/. Information contained on our website is not incorporated into this Proxy Statement. | ||

| 20 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

Understanding

| 21 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

COMMUNICATING WITH MANAGEMENT AND IR Our Investor Relations department is the primary point of contact for stockholder interaction with AdvanSix. Stockholders should write to or call: Adam Kressel

Vice President, Investor Relations and Treasurer AdvanSix Inc., 300 Kimball Drive, Suite 101, Parsippany, New Jersey 07054 Phone: +1 (973) 526-1700 Visit our website at We encourage our stockholders to visit the “Investors” section of our website for more information on our investor relations and corporate governance programs. | ||

PROCESS FOR COMMUNICATING WITH BOARD MEMBERS Stockholders, as well as other interested parties, may communicate directly with the AdvanSix’s Corporate Secretary reviews and promptly forwards communications to the directors as appropriate. | ||

|

| 22 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

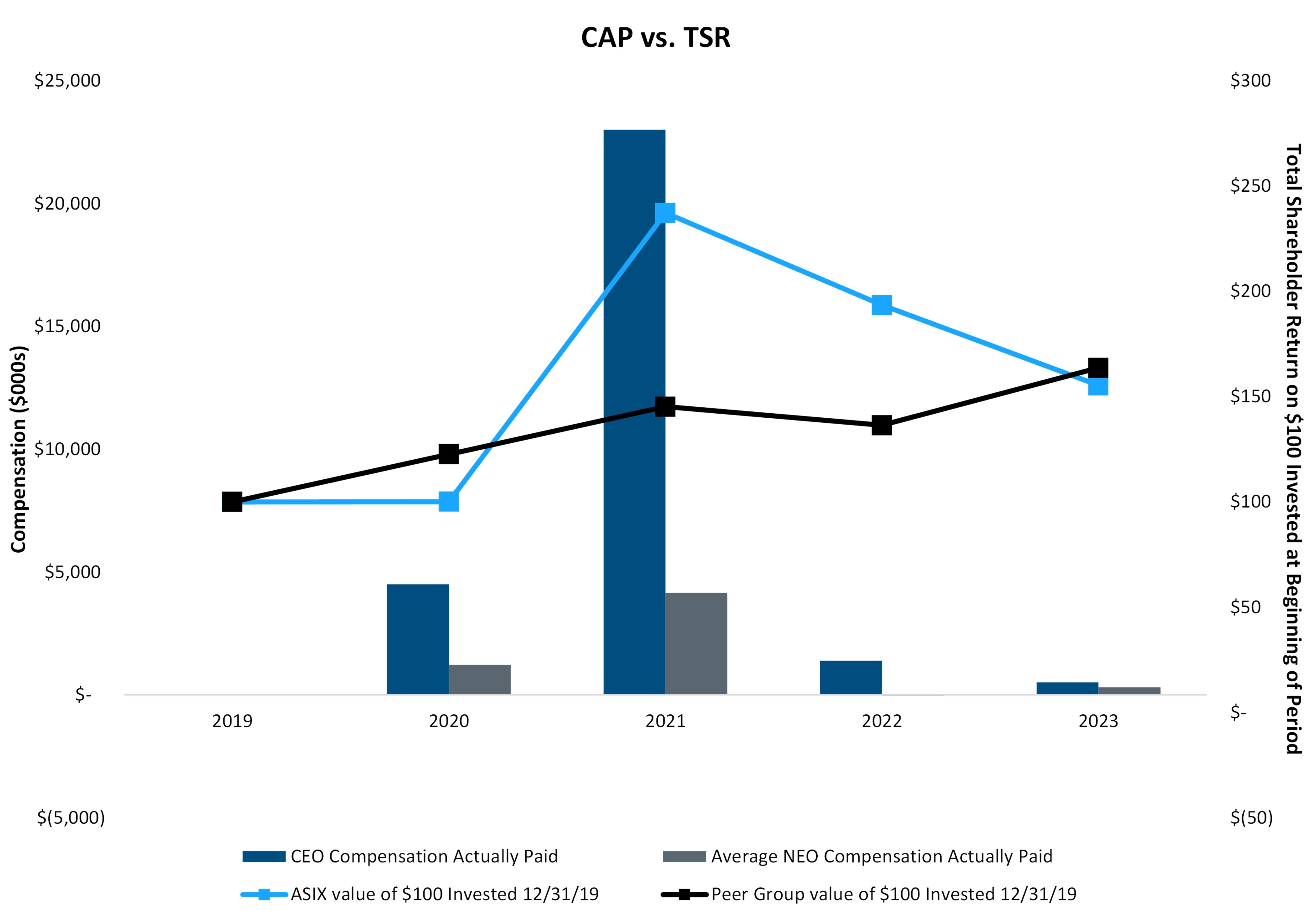

Executive Summary

Fiscal 2016 was a transformational year for AdvanSix Inc. On October 1, 2016, Honeywell International Inc., our former parent, completed the previously announced separation of AdvanSix, its Resins and Chemicals business. The separation was completed by Honeywell distributing all of the then outstanding shares of common stock of AdvanSix on October 1, 2016 through a dividend in kind of AdvanSix common stock, par value $0.01, to holders of Honeywell common stock as of the close of business on the record date of September 16, 2016 who held their shares through the distribution date. Each Honeywell stockholder who held their shares through the distribution date received one share of AdvanSix common stock for every 25 shares of Honeywell common stock held at the close of business on the record date. On October 3, 2016, AdvanSix stock began “regular-way” trading on the NYSE under the “ASIX” stock symbol.

This Compensation Discussion and Analysis (“CD&A”) describes the compensation philosophy, programs and practices adopted by the Compensation Committee of the Board of Directors of AdvanSix (the “Compensation Committee”) for its senior executive officers following the spin-off. This CD&A also discusses, in part, the historical compensation programs and practices of our former parent Honeywell because, until the completion of the spin-off, decisions about our executive compensation and benefits were made primarily by the Management Development and Compensation Committee of the Honeywell Board of Directors (the “Honeywell Compensation Committee”) and Honeywell senior management, and the executive compensation programs in place at the time of the spin-off were those established by Honeywell on our behalf. Because our Named Executive Officers (“NEOs”) were not executive officers of Honeywell, their compensation for 2016 prior to the spin-off was determined primarily by Honeywell senior management.

Following the spin-off, our Compensation Committee has undertaken a review of each element of our compensation programs. As a new, independent public company, we believe that the spin-off offers an exciting opportunity that enables us to offer our key employees with compensation directly linked to the performance of our business, which we expect will enhance our ability to attract, retain and motivate qualified personnel and serve the interests of our stockholders. As described below under “2017 Compensation Decisions,” our Compensation Committee established our executive compensation program for 2017, our first full year as an independent company. Some of the key actions by the Compensation Committee for the 2017 program include:

As addressed in further detail in this CD&A, the initial compensation of our NEOs following the spin-off is governed largely by the terms of the employment letter agreements entered into with each of them prior to the spin-off (“Employment Letter Agreements”), as well as the Separation and Distribution Agreement (“Separation Agreement”) and the Employee Matters Agreement (“Employee Matters Agreement”), each dated September 22, 2016, entered into between us and Honeywell in connection with the spin-off. A description of the Employment Letter Agreements can be found below in this CD&A under the heading “NEO Employment Letter Agreements.”

Our Executive Leadership Team

.

| Erin N. Kane | President and Chief Executive Officer (CEO) | ||||||||||

| Michael Preston | Senior Vice President and Chief Financial Officer (CFO) | ||||||||||

| Achilles B. Kintiroglou | Senior Vice President, General Counsel and Corporate Secretary | ||||||||||

| Kelly Slieter | Senior Vice President and Chief Human Resources Officer | ||||||||||

| Christopher Gramm | Vice President and Controller | ||||||||||

|

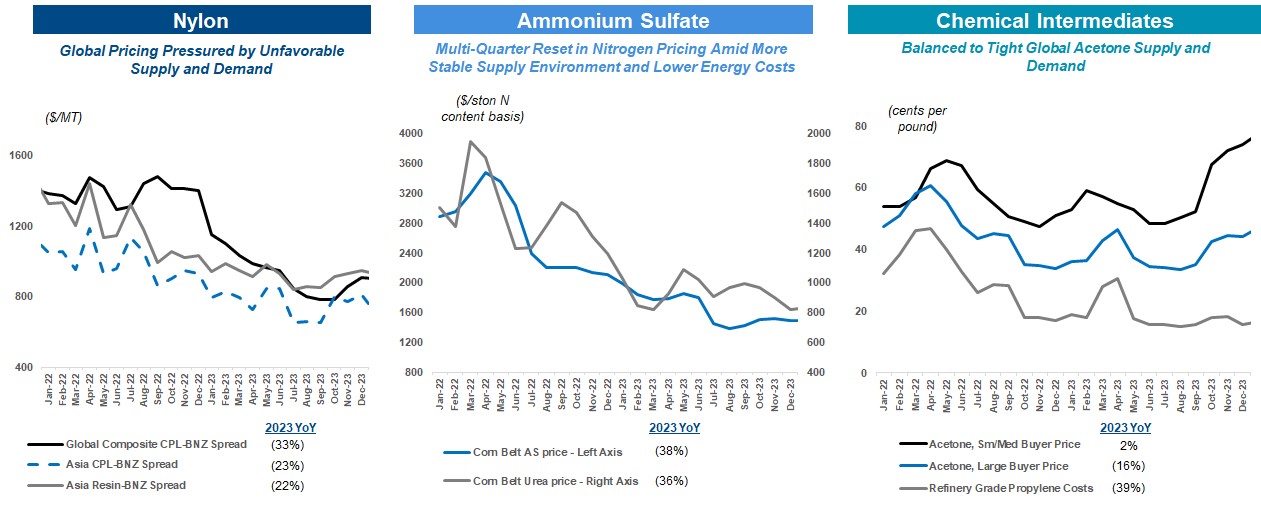

| ($ in Thousands) | 2023 Sales | 2022 Sales | % Change YoY | ||||||||||||||

| Nylon | $ | 356,632 | $ | 485,241 | -27% | ||||||||||||

| Caprolactam | 298,375 | 319,863 | -7% | ||||||||||||||

| Ammonium Sulfate | 440,915 | 629,021 | -30% | ||||||||||||||

| Chemical Intermediates | 437,677 | 511,515 | -14% | ||||||||||||||

| Total | $ | 1,533,599 | $ | 1,945,640 | -21% | ||||||||||||

| 23 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| 24 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

our NEOs.

sound management

| 25 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

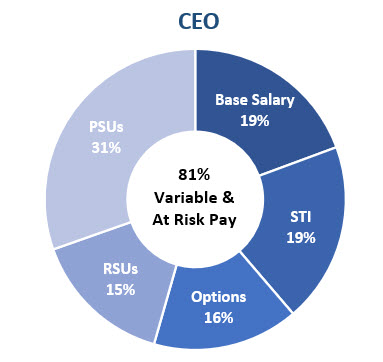

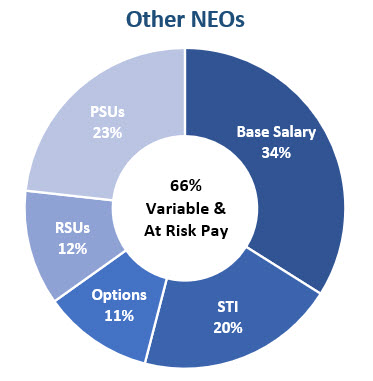

| Compensation Element | Description | Objectives | ||||||||||||

| Base Salary | Fixed cash compensation; reviewed annually and subject to adjustment | Attract, retain and motivate our NEOs | ||||||||||||

| Short-Term Cash Incentive Compensation | Annual cash incentive compensation based on performance against annually established Company financial and operational performance goals, as well as strategic objectives | Reward and motivate our NEOs for achieving key short-term performance objectives | ||||||||||||

| Long-Term Equity Incentive Compensation | Annual equity compensation awards of PSUs (with payout tied to achievement of Company financial and operational goals measured over a 3-year performance period, with an rTSR modifier), time-based RSUs and stock options | Align NEO interests with those of our stockholders by rewarding the creation of long-term stockholder value and encouraging stock ownership; reward and motivate our NEOs for achieving key long-term performance objectives | ||||||||||||

| Health, Welfare and Retirement Benefits | Qualified and non-qualified retirement plans and health care and insurance benefits | Attract and retain NEOs by providing market-competitive benefits | ||||||||||||

| Severance and Change-in-Control Arrangements | Reasonable severance benefits provided upon covered terminations of employment, including following a change in control | Attract and retain high quality talent by providing market-competitive severance protection, thereby encouraging NEOs to direct their attention to stockholders’ interests notwithstanding the potential for loss of employment in connection with a change in control | ||||||||||||

| 26 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

| What We Do | What We Don’t Do | |||||||||||

| l | Pay-for-performancephilosophy designed to emphasize compensation tied to creation of stockholder value | l | No excise tax gross-upsupon a change in control | |||||||||

| l | Retention of anindependent compensation consultant | l | No significant perquisites and no gross-upson perquisites | |||||||||

| l | Multiple performance metrics for short-term and long-term incentive compensation; different metrics used for each plan | l | No excessive severance or change in controlprotection | |||||||||

| l | Maximum cap on our incentive award payouts | l | No repricing or replacement of stock options without stockholder approval | |||||||||

| l | Deliver a substantial portion of executives’ target totaldirect compensation in the form of variable, “at risk,”performance-based compensation | l | No hedging and pledging permitted by our executives and directors | |||||||||

| l | Robust compensation governance practices, including annual CEO performance evaluation | |||||||||||

| l | ||||||||||||

Double triggerprovisions for accelerated vesting of equity awards upon a change in control | ||||||||||||

| l | Stock ownership guidelines | |||||||||||

| l | Annual limit on director compensation | |||||||||||

| l | Guard against competitive harmby obtaining our executives’ agreement to non-competition compensation forfeiture clauses and other restrictive covenants | |||||||||||

| l | ||||||||||||

Apply clawback obligations to certain incentive-based and equity-based compensation awards for executive officers pursuant to our clawback policy and our 2016 Stock Incentive Plan | ||||||

In addition,

the peer group: Koppers Holdings, Inc., LSB Industries, Inc., Mativ Holdings, Inc., Orion Engineered Carbons S.A. and Tronox Holdings plc. As a result, the following represents the updated peer group used for 2023:

| American Vanguard | H.B. Fuller | Mativ Holdings, Inc. | Stepan Co. | ||||||||

| Cabot Corp. | Ingevity Corp. | Minerals Technologies Inc. | Tredegar Corp. | ||||||||

| Ferro Corp. | Innospec Inc. | Orion Engineered Carbons S.A. | Trinseo | ||||||||

| GCP Applied Technologies | Koppers Holdings, Inc. | Quaker Chemical Corp. | Tronox Holdings plc | ||||||||

| Hawkins Inc. | LSB Industries, Inc. | Sensient Technologies Corp. | |||||||||

| 27 | Proxy and Notice of Annual Meeting of Stockholders | 2024 | ||||||||||||

Followingbetter align with peer group data for compensation benchmarking and to acknowledge individual performance. The following are the spin-off, theannual base salaries of our NEOs: Ms. Kane, $1,019,700; Mr. Preston, $490,000; Mr. Kintiroglou, $480,000, representing an approximately 6% increase; Ms. Slieter, $430,000, representing an approximately 8% increase; and Mr. Gramm, $321,360, representing an approximately 3% increase. These base salaries of our NEOs were established pursuant to their respective Employment Letter Agreements. Effective upon the spin-off, the annualeffective March 18, 2024. The base salaries of our NEOs were as follows: Ms. Kane $600,000;and Mr. Preston $400,000; Mr. Quitmeyer, $500,000; Mr. Bellamy, $330,000; and Mr. Gramm, $270,000.

were not increased for 2024 based on competitive compensation benchmarking.

In February 2017, our Compensation Committee established cash incentive awards for the period in 2016 following the spin-off. In determining the awards, the Compensation Committee first established the amount of the overall bonus pool available for grant to certain employees eligible for a short-term cash incentive award, including our NEOs. In doing so, the Compensation Committee reviewed the Company’s financial performance against an annual operating plan, which was adjusted following the spin-off to reflect AdvanSix financials on a standalone basis in order to develop appropriate awards. The Committee’s review focused on EBITDA, free cash flow and working capital turns with strong consideration of performance relative to the adjusted annual operating plan. As compared to this post-spin adjusted annual operating plan, the Committee considered that the Company achieved an average total of 72% achievement against the “targeted” adjusted operating plan with respect to EBITDA, free cash flow and working capital turns. Accordingly, the Compensation Committee funded the available award pool at $3.063 million in the aggregate for all participants. Individual awards were then determined consistent with annual performance reviews and the Company’s philosophy of differentiating awards for top performers. Based on this, in March 2017, our NEOs were paid the following cash incentive awards under this program: Ms. Kane, $107,704, Mr. Preston, $50,262, Mr. Quitmeyer, $67,315, Mr. Bellamy, $35,542, and Mr. Gramm, $16,963.

Long-Term Incentive Compensation

In February 2016, our NEOs were granted long-term incentive awards in the form of Honeywell stock options, restricted stock units, or “RSUs,” and growth plan units, or “GPUs,” as described in more detail below. In accordance with the Employee Matters Agreement, outstanding long-term incentive awards granted by Honeywell remained outstanding and continued to vest for specified periods following the spin-off, at which point in time, any unvested awards are forfeited. In October 2016, following the spin-off, our NEOs were granted AdvanSix special one-time RSU awards in the form of “founders grants” in recognition of their efforts related to the spin-off and to replace those Honeywell long-term incentive awards that were forfeited in connection with the spin-off.

Honeywell Stock Options and RSUs

Honeywell generally granted equity awards in February of each year during an open trading window period following the release of its financial results for the preceding fiscal year. In determining the size of equity awards, Honeywell considered an

|

executive’s prior year performance, his or her potential to contribute to the future performance of Honeywell and his or her business unit and the vested and unvested equity held by the applicable executive.

Stock option awards are long-term incentives intended to motivate and reward executives for making strategic decisions and taking actions that drive year-over-year improvements in company performance that translate into future increases in stock price. Stock options are directly aligned with the interests of stockholders because executives only realize value if the stock price appreciates. Annual Honeywell stock option awards generally vested over four years.

RSUs represent a right to receive common stock if certain conditions are met (e.g., continued employment through a specific date or the attainment of certain performance conditions). RSU awards are intended to reward executives for improvements in Company performance and are linked with stockholder value since the value of RSU awards rises or falls with the stock price. RSUs are also intended to encourage retention as they generally vest after a period of three years.

In connection with the spin-off, Honeywell stock options and RSUs held by AdvanSix employees continued to vest in accordance with their original vesting schedule based on continued service with AdvanSix from the date of the spin-off through, in the case of stock options, March 1, 2017, and, in the case of RSUs, the end of July 2017. Such awards are generally treated as provided in the Honeywell incentive compensation plan under which such equity was awarded and the award agreements governing such awards. Any remaining unvested stock options that did not vest on or prior to March 1, 2017 were forfeited, and any remaining unvested RSUs that do not vest on or prior to July 31, 2017 will be forfeited.

In 2016, our NEOs received the following grants from Honeywell: Ms. Kane: 9,051 stock options and 1,509 RSUs; Mr. Preston: 8,045 stock options and 1,348 RSUs; Mr. Quitmeyer: 14,080 stock options and 2,354 RSUs; Mr. Bellamy: 3,017 stock options and 503 RSUs; and Mr. Gramm: 6,537 stock options and 1,097 RSUs. The options had an exercise price of $103.07 and provided for vesting in equal 25% installments over a four-year period. The RSUs provided for cliff vesting at the end of a three-year period. Following the spin-off, one-quarter of each NEO’s stock option grant vested in February 2017, and the remaining unvested stock options were forfeited on March 1, 2017. The NEOs have three years following the spin-off, subject to any earlier expiration date, to exercise their Honeywell stock options. The RSUs, which were not scheduled to vest until February 2019, are expected to be forfeited on July 31, 2017.

Honeywell GPUs

Honeywell’s Growth Plan, as in effect for our NEOs prior to the spin-off, provided performance-contingent, cash-based, longer-term incentive awards in the form of GPUs to focus executives on achievement of objective, two-year financial metrics that aligned with Honeywell’s long-term targets then in effect. The operational focus of the Growth Plan was intended to complement stock options and RSUs, which reward stock price appreciation.

The Growth Plan generally consisted of two-year, non-overlapping performance cycles (e.g., 2014-2015), with payout of any earned amounts occurring 50% in March of each of the following years (i.e., 2016 and 2017). Vesting of GPU grants made in 2014 was contingent upon achievement of three pre-established financial targets measured over the two-year performance cycle (January 1, 2014 through December 31, 2015): revenue growth (excluding acquisitions and divestitures), return on investment (“ROI”) expansion and segment margin expansion. Earned awards were paid 50% in March 2016, and in accordance with the Employment Letter Agreements, the remaining 50% was paid in March 2017 by Honeywell following the spin-off. For additional information on Honeywell’s 2014-2015 Growth Plan and performance results, see “Details on Program Elements and Related 2015 Compensation Decisions-Growth Plan” in Honeywell’s Compensation Discussion and Analysis included its proxy statement filed on March 10, 2016.

In 2016, each NEO was granted a Honeywell GPU award intended to cover the 2016-2018 performance cycle. These GPU awards were forfeited at the effective time of the spin-off.

Spin-Off Equity Grants

In October 2016, pursuant to the terms of their Employment Letter Agreements, each of our NEOs received a special one-time equity award. These awards generally consisted of two components: (1) a “founders grant” with a value equal to 250% for Ms. Kane, and 200% for our other NEOs, of the executive’s annual target long-term incentive compensation opportunity, and (2) a replacement grant intended to replace certain Honeywell equity awards and GPUs that were forfeited as a result of the spin-off. Honeywell determined that the founders grants were in AdvanSix’s best interest in order to: (1) attract and retain a talented executive team, and in Ms. Kane’s case, a Chief Executive Officer that was familiar with both Honeywell and AdvanSix and could therefore provide effective guidance and leadership before, during and after the spin-off; (2) appropriately align our executive officers’ interests with those of AdvanSix’s stockholders and provide a strong incentive to increase stockholder value following the spin-off; and (3) recognize these executives’ commitment to AdvanSix and our stockholders, demonstrated by their willingness to depart Honeywell at a time of exciting growth and opportunity in order to exclusively devote their knowledge and talents to AdvanSix at this critical stage in its development as a new public company.

|

These special one-time awards were made in the form of AdvanSix RSUs subject to service-based vesting conditions. The grant value of each NEO’s award was as follows, and the number of RSUs granted was determined by dividing the applicable grant value by the closing price per share of AdvanSix common stock on the October 3, 2016 grant date:

| Founders | Replacement | Total Award | Total RSUs | |||||||||||||

| Grant | Grant | Amount | Awarded | |||||||||||||

| ($) | ($) | ($) | (#) | |||||||||||||

| Erin N. Kane | $ | 5,625,000 | $ | 1,058,587 | $ | 6,683,587 | 407,288 | |||||||||

| Michael Preston | $ | 1,200,000 | $ | 1,081,000 | $ | 2,281,000 | 139,001 | |||||||||

| John M. Quitmeyer | $ | 1,500,000 | $ | 887,000 | $ | 2,387,000 | 145,461 | |||||||||

| Jonathan Bellamy | $ | 660,000 | $ | 265,000 | $ | 925,000 | 56,369 | |||||||||

| Christopher Gramm | — | $ | 575,000 | $ | 575,000 | 35,040 | ||||||||||

The grants are scheduled to cliff-vest on the third anniversary of the grant date (October 3, 2019). If the NEO’s employment terminates due to death or disability or if the awards are not assumed in a change in control, the awards vest in full. If the awards are assumed in connection with a change in control, they will vest in full upon a termination of the NEO’s employment without cause or for good reason within two years following the change in control, referred to as a “double trigger.”

NEO Employment Letter Agreements

Overview

The NEO Employment Letter Agreements were determined and negotiated by Honeywell management in advance of the spin-off utilizing an independent compensation consultant. Following the spin-off, the Board and Compensation Committee reviewed the NEO Employment Letter Agreements and, in consultation with its own independent compensation consultant, determined them to be appropriate.

Erin Kane

On April 19, 2016, Ms. Kane and Honeywell entered into a letter agreement to provide that Ms. Kane would become our Chief Executive Officer, effective upon the spin-off. Under the terms of the agreement, Ms. Kane is entitled to receive a starting base salary of $600,000 and will have an annual target incentive opportunity of 100% of annual base salary. The agreement provided that, for 2016, Ms. Kane would receive an annual incentive award for the period prior to the spin-off equal to 40% her 2016 base salary earned during such period and would be eligible to receive an annual incentive award from AdvanSix for the period following the spin-off based on Ms. Kane’s 2016 base salary earnings during such period. The agreement further provided that for the period following the spin-off, Ms. Kane would be eligible to receive long-term incentive compensation opportunities with a target value equal to 375% of Ms. Kane’s annual base salary and would also be entitled to participate in the benefit programs that we offer to our employees generally.

The agreement also provided that at the time of the spin-off, Ms. Kane would receive the special one-time grant of AdvanSix RSUs described above.

Compensation and Benefits of AdvanSix’s Other Executive Officers

In May 2016, each of Michael Preston, John M. Quitmeyer and Jonathan Bellamy, and in August 2016, Christopher Gramm entered into a letter agreement with Honeywell to provide that Messrs. Preston, Quitmeyer, Bellamy and Gramm would become, respectively, our Senior Vice President and Chief Financial Officer; Senior Vice President, General Counsel; Chief Human Resources Officer; and Vice President and Controller effective upon the spin-off. None of Messrs. Preston, Quitmeyer, Bellamy, and Gramm had previously provided services to the AdvanSix business. Under the terms of the applicable agreement, the executives are entitled to the following starting base salaries and annual target incentive opportunities as a percentage of base salary: Mr. Preston, $400,000 and 70%, Mr. Quitmeyer, $500,000 and 75%, Mr. Bellamy, $330,000 and 60%, and Mr. Gramm $270,000 and 35%.